Why Supply Chains Matter

India has set its sights on producing 5 million tonnes of green hydrogen every year by 2030. It is a bold and transformative goal for India’s energy transition. Supply chains are the invisible tracks on which this journey will run. And the truth is that a real and immediate opportunity lies in building infrastructure to move this hydrogen safely and efficiently. It would translate into ports that can handle hydrogen, pipelines that can move it, storage that can keep it safe, and suppliers who can manufacture and deliver the right parts at the right time at the right cost. With a coordinated effort, India is well poised to be a beneficiary of the energy transition, securing a strategic position in the global hydrogen industry while giving a significant push to the GDP and employment.

Yet, achieving this coordinated effort will not be without its challenges. Building a reliable hydrogen supply chain—from production inputs to storage and transport—demands scale, standardization, and strong collaboration across multiple sectors. This blog aims to outline the key supply chain challenges in India’s emerging hydrogen economy, identify the stakeholders shaping this landscape, and suggest practical actions to begin addressing them.

Where Are the Cracks Today?

The promise of a hydrogen economy in India is an admirable vision, and the foundation for it is beginning to take shape. However, building the necessary infrastructure remains a work in progress. India currently has only a few experimental hydrogen pipelines and no dedicated cross-state transmission system. Most existing gas pipelines can accommodate limited hydrogen blending—around 15–20%—which constrains their use for industrial-scale production and distribution. Expanding this capacity will be key to enabling wider adoption and export potential.

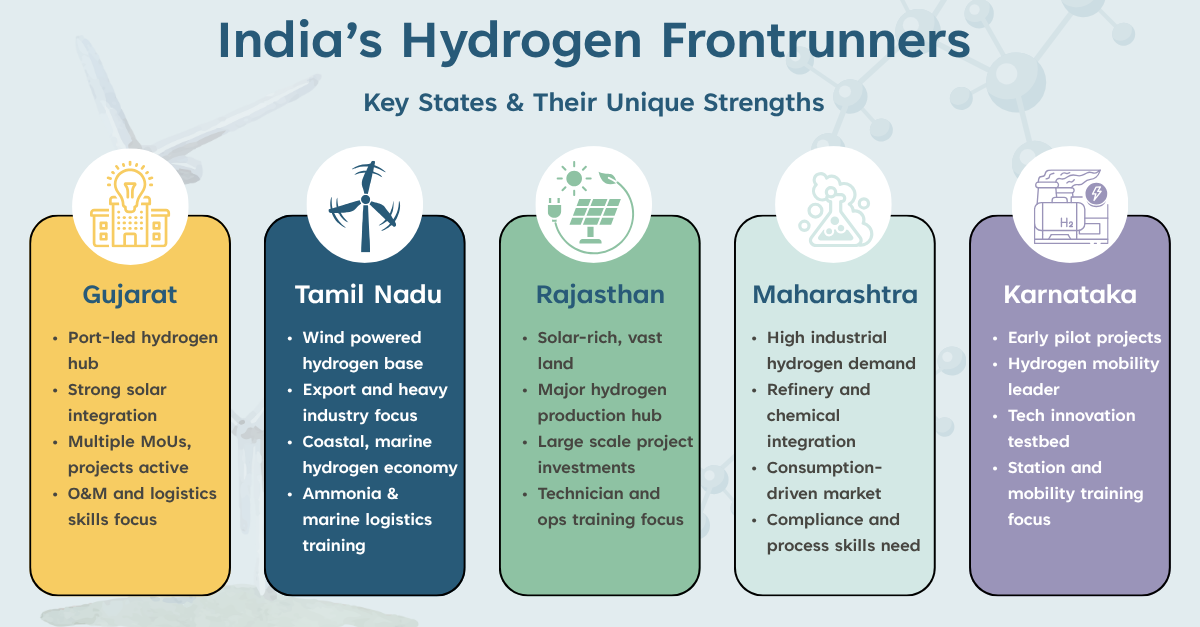

Ports are in the early stages of readiness to handle hydrogen and its derivatives. A few, such as the VOC Port in Tamil Nadu and the Deendayal Port in Gujarat, have begun hydrogen-readiness assessments. The VOC Port’s pilot project, launched in 2024, produces 10 Nm³ of green hydrogen per hour at a cost of ₹3.87 crore. It currently powers streetlights and EV chargers within the port complex and is complemented by a ₹35 crore methanol bunkering pilot exploring hydrogen derivatives. These initiatives are small in scale but mark important first steps toward commercial readiness.

Another area gaining attention is the supply of technology and equipment. Most key components—such as electrolyser stacks, catalysts, membranes, and high-pressure tanks—are still imported from Europe and East Asia, though domestic capabilities are expanding. India’s electrolyser manufacturing capacity stands at roughly 2–3 GW per year, while demand could reach 60 GW by 2030, according to NITI Aayog. Encouragingly, companies such as GreenH Electrolysis, Ohmium and Thermax are entering the space, supported by growing interest in technology partnerships and localisation. Strengthening this domestic ecosystem will be essential to reduce dependence on imports and ensure a resilient supply chain as demand accelerates.

(Source: India Briefing, WRI India, Times of India, Rystad Energy)

Building Blocks of a Future-Ready Chain

Upstream – Electrolysers and Renewable Integration

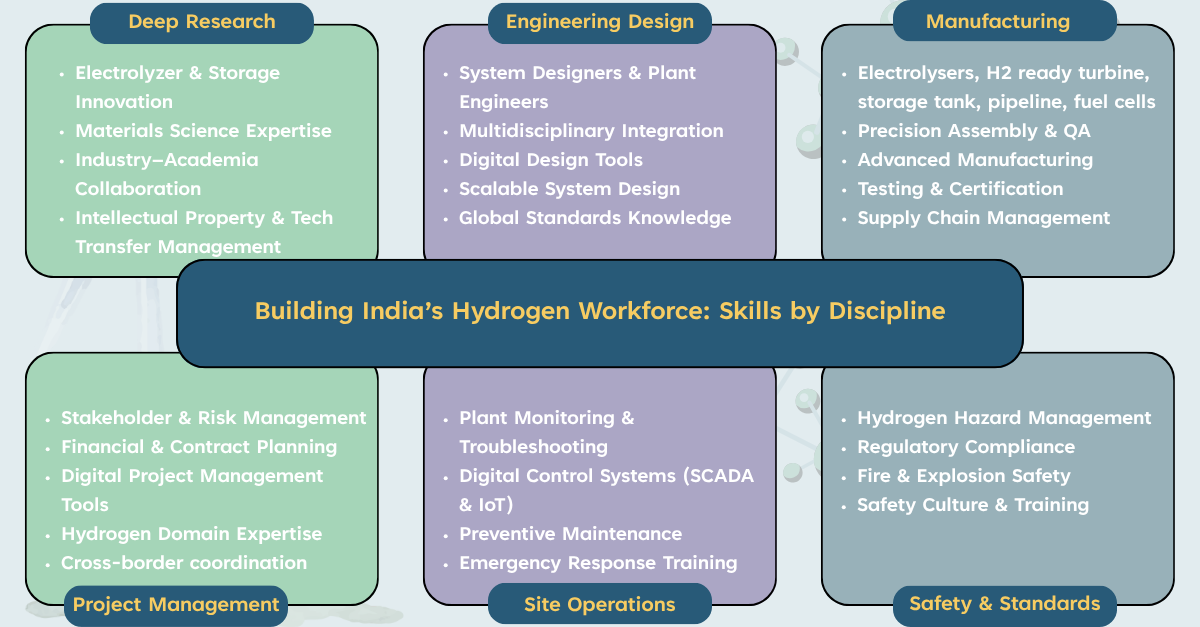

Electrolysers are the beating heart of the hydrogen economy. They convert renewable energy into hydrogen, but to do this at scale, India needs more than just machines. It needs a domestic manufacturing base for electrolysers and critical components (chemicals, high pressure tubes/pipes valves and instruments etc) required for manufacturing electrolysers, so it is not completely dependent on imports.

It also needs better integration with renewable sources, along with smart grid management and (electrical) storage solutions to deal with the ups and downs of solar and wind power. Renewable power evacuation corridors, from Rajasthan’s solar belt and Tamil Nadu’s wind clusters, must be linked directly to hydrogen production hubs for cost efficiency. (Source: RMI, GH2 India, NITI Aayog)

Renewable energy contributes close to 70% of the cost of electrolyser, and availability of round the clock renewable energy at improved cost is going to be key driver of electrolyser technology adaptation.

Equally important is water supply chain. India’s hydrogen production will demand around 50 billion litres of de-mineralised water annually, requiring desalination and recycling in arid zones.

Producing hydrogen is one thing but moving it is another story. Transporting hydrogen requires specialised pipelines or the repurposing of natural gas lines. It also needs robust storage systems that can keep hydrogen stable and safe. At ports, hydrogen-ready bunkering, cryogenic storage, and multimodal facilities must be set up, so India can actually ship hydrogen and its derivatives abroad.

The Petroleum and Natural Gas Regulatory Board (PNGRB) is currently evaluating a 1,500 km hydrogen corridor connecting Rajasthan’s renewable hubs to Gujarat’s ports. Meanwhile, the National Highways Authority of India has shortlisted five “green corridors” for potential hydrogen transport. These will form the backbone for midstream logistics.

In addition, India is developing hydrogen valleys with integrated production and consumption clusters. The Andhra Pradesh Hydrogen Valley and Gujarat Hydrogen Cluster, announced in 2025, aim to co-locate electrolysis, industrial users, and port logistics, reducing transport costs and energy losses by up to 20 per cent.

(Source: Hydrogen Europe, India Briefing, MNRE)

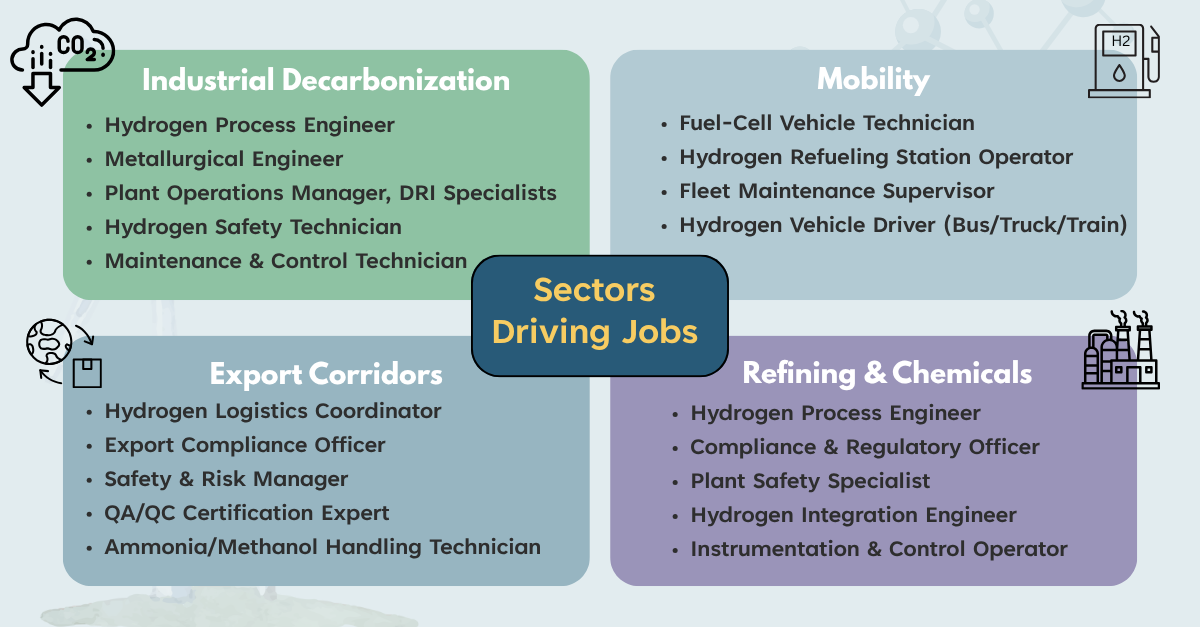

Downstream – Industries and Export Hubs

Hydrogen must find a home in real industries for it to make an impact. Steelmakers, fertilizer plants, and heavy-duty transportation sector are the natural candidates. India’s steel industry alone could absorb nearly 1.5 million tonnes of hydrogen annually by 2030, if 30 percent of production transitions to direct-reduced-iron (DRI) routes, according to Indian Steel Association (ISA) estimates. Fertilizer blending could add another 1 million tonnes, while refineries and heavy transportation could jointly add a further 2 million.

At the same time, export hubs are beginning to take shape. The massive project near Mulapeta Port in Andhra Pradesh aims to produce 180,000 tonnes of green hydrogen and 1 million tonnes of green ammonia per year by 2029. These hubs not only create demand but also position India to become a global supplier in hydrogen derivatives.

(Source: IH2A, Government of India, ISA)

The Role of MSMEs

No supply chain is complete without small and medium enterprises. MSMEs are expected to play a vital role in localizing hydrogen technologies. In Chennai, Hyundai and IIT-Madras are already working with MSMEs on everything from electrolyser coatings to refueling systems. These partnerships could expand to over 400 MSMEs across Tamil Nadu, Gujarat, and Maharashtra by 2030, supported through vendor-development clusters and state innovation grants. Building such partnerships can make India’s supply chains self-reliant and globally competitive. (Source: Times of India, TN Industries Dept. 2025 Report)

Steps Taken So Far

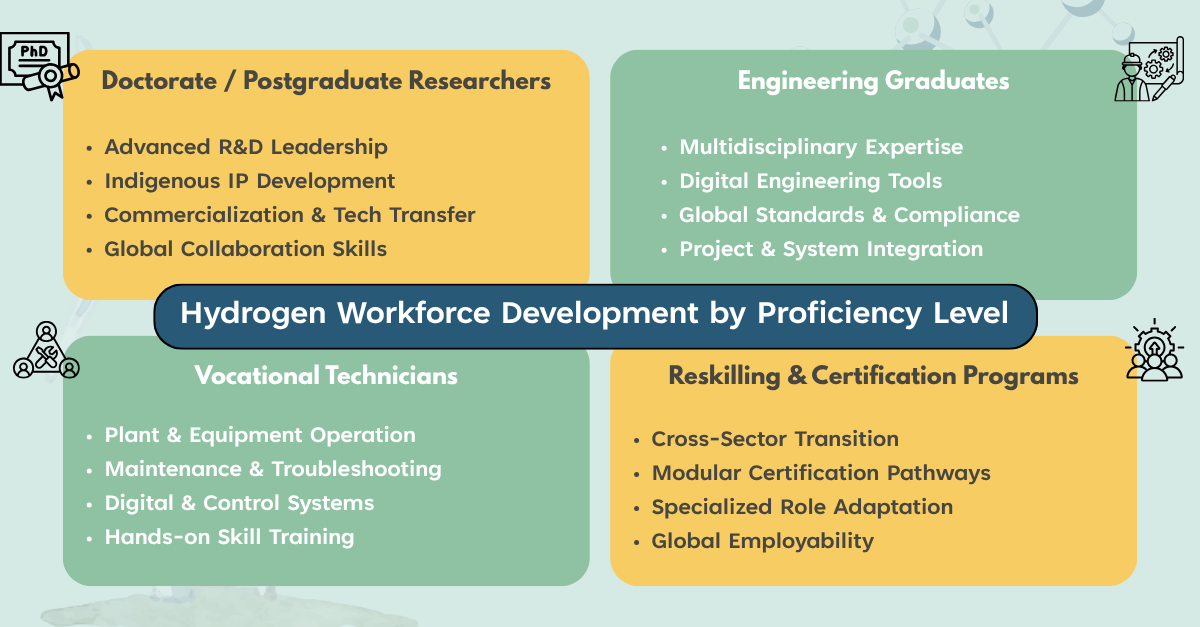

India has begun converting its hydrogen plans into tangible progress, though much remains in pilot stages. The National Green Hydrogen Mission, launched in 2023, outlines a 5 million tonne annual target by 2030, underpinned by ₹ 19,744 crore in central budget allocation.

The National Logistics Policy has begun to recognize hydrogen as part of the larger transportation ecosystem. However, the policy does not yet provide detailed roadmaps or funding models. This lack of clarity means that while hydrogen has a place on paper, the ground-level execution remains uncertain.

(Source: GH2 India, Government of India, MNRE 2024)

Some pilot projects are beginning to show what is possible. At VOC Port in Tuticorin, a green hydrogen project is already generating hydrogen for use in powering streetlights and charging electric vehicles. This is the country’s first port-based hydrogen pilot; now operating a 10 Nm³/hr electrolyser. Alongside, a ₹ 35 crore methanol bunkering project is testing hydrogen-derived fuels.

The port has also laid the foundation for a methanol bunkering facility. These are small steps, but they demonstrate how ports could evolve into hubs for hydrogen activity in the future. (Source: Economic Times)

Beyond pilots, larger industrial projects are also coming into focus. The planned facility near Mulapeta in Andhra Pradesh represents one of the most ambitious projects so far, with an investment of ₹10,000 crore. This Andhra Pradesh Hydrogen and Ammonia Plant is one of India’s largest, targeting 180 KTPA hydrogen output and 1 MTPA ammonia. Gujarat’s Deendayal Port and Dahej SEZ are also under feasibility studies for ammonia terminals and hydrogen handling. It aims to integrate desalination, electrolysers, and export-ready pipelines, creating one of India’s first large-scale hydrogen and ammonia hubs.

(Source: Times of India, IH2A)

In addition, India has begun exploring hydrogen valleys, where production, distribution, and consumption are integrated within specific clusters. These valleys create a living laboratory for scaling technologies and linking industry players, helping to accelerate learning and reduce costs.

Finally, the government has also moved toward setting standards. The launch of the Green Hydrogen Certification Scheme in 2025 is a step forward in ensuring credibility, uniformity, and international acceptance of Indian hydrogen. Certification could become a cornerstone of India’s export ambitions. (Source: IH2A)

What Else Matters in India’s Race for Hydrogen Leadership?

As India builds its green hydrogen backbone, it must also prepare for risks that could derail progress. One of the biggest needs is a strong risk management framework. Global supply chains are vulnerable to price spikes, shipping disruptions, and geopolitical uncertainty. Unless India has clear systems in place to manage these shocks, its hydrogen journey could face sudden roadblocks.

Global dependency on critical raw materials is one of the most pressing concerns. Key inputs like nickel, iridium, and platinum, which are essential for electrolysers and fuel cells, are concentrated in a handful of countries. Indonesia and Russia dominate nickel supply, while South Africa leads in platinum and Iridium. Any supply disruption or export restriction could increase costs by up to 30–40 per cent. Developing domestic substitutes, local refining, and circular-economy recycling systems for catalysts is therefore essential to maintain long-term resilience. (Source: WRI India, IEEFA)

Another major challenge is India’s dependence on imported materials and components. Many of the most critical technologies, which would be electrolyser stacks, high-grade steel, and specialised coatings, come from abroad. This dependence creates a bottleneck that India cannot control. While domestic companies like GreenH Electrolysis, Ohmium and Thermax are taking steps to localise manufacturing, achieving scale will require policy-backed research, manufacturing incentives, and international technology partnerships. Strengthening domestic R&D and MSME participation will help bridge this gap. (Source: Times of India)

Equally important is ensuring that infrastructure growth happens in a coordinated and synchronised way. Pipelines, ports, storage facilities, and supplier networks must develop together. If one part of the chain lags, for instance, ports without bunkering capacity or pipelines without renewable corridors, the entire system risks inefficiency and delays. A national coordination mechanism among MNRE, PNGRB, state governments, and industry bodies, can ensure alignment in timelines, investment, and permitting. A holistic approach is the only way to keep the supply chain strong and future-proof.

India must also stay focused on cost competitiveness. Green hydrogen currently costs around $4–5 per kg, compared with $1.5–2 per kg for grey hydrogen. To reach parity by 2030, costs need to fall below $2 per kg. This can only be achieved through a combination of falling renewable tariffs (which are already near ₹2.2 per kWh), large-scale electrolyser production (targeted to exceed 25 GW per year), and efficient logistics networks that minimise transmission losses. (Source: RMI India, NITI Aayog)

Alongside these supply-side concerns, India must also focus on creating market demand. Without clear demand generation, even the best infrastructure could remain underutilised. Concrete policy actions such as incentives for hydrogen use in steelmaking, fertiliser blending, and mobility, as well as public procurement targets, will be key to jumpstarting domestic adoption. The government’s Strategic Interventions for Green Hydrogen Transition (SIGHT) program, which offers incentives of up to ₹50 per kg for early production, is a step in this direction. By creating steady demand and long-term offtake contracts, market forces can drive investment throughout the supply chain, ensuring sustainable growth.

(Source: IEEFA, MNRE 2025)

What the World Is Doing?

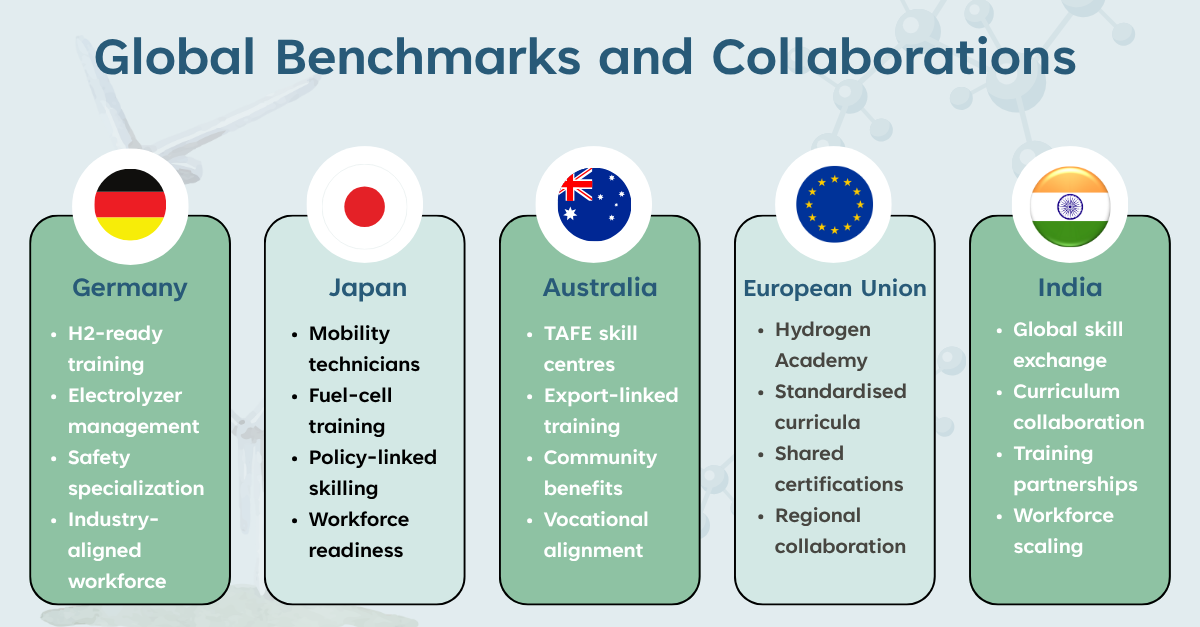

Japan

Japan has made significant progress in creating hydrogen-ready ports and fueling infrastructure. The country now operates over 160 hydrogen refuelling stations, supported by the government’s long-term clean energy vision. It plans to import up to 3 million tonnes of clean hydrogen annually by 2030, with a total investment of around ¥15 trillion spread over 15 years.

Japan has also been working to establish international hydrogen supply chains, collaborating with Australia, Brunei, and Saudi Arabia to import clean hydrogen and ammonia. In addition, the country has begun converting several key ports, such as Kawasaki and Yokohama, into hydrogen-ready terminals equipped with liquefied hydrogen storage and bunkering facilities. These projects reflect Japan’s clear intent to lead the global hydrogen trade.

(Source: Reuters, METI Japan)

European Union

The European Union’s approach focuses on scale, integration, and coordination. Under its Hydrogen Backbone plan, the EU aims to develop 40,000 kilometres of dedicated hydrogen pipelines by 2040, connecting key production and consumption centres across Europe.

Through the REPowerEU strategy, the bloc has allocated €10 billion specifically for hydrogen infrastructure, targeting 20 million tonnes of hydrogen consumption by 2030. This includes both domestic production and imports from global partners such as North Africa and the Middle East.

Several member states are moving rapidly on their national hydrogen networks. For instance, Germany and the Netherlands have already begun converting sections of existing gas pipelines to hydrogen use, while Spain is developing green corridors connecting its solar generation hubs with export terminals along the Mediterranean.

While the rollout has faced some delays, the EU’s integrated planning, regulatory clarity, and investment alignment, remain valuable lessons for countries like India that are still at an early stage.

(Source: Hydrogen Europe, Financial Times, European Commission REPowerEU)

Lessons for India

The key lesson for India is timing. Japan and the European Union began developing logistics, storage, and infrastructure years before large-scale hydrogen production matured. Their approach ensured that when hydrogen production expanded, the systems to store, transport, and utilise it were already in place.

India has a unique opportunity to leapfrog this process. By planning production, transport, and consumption infrastructure simultaneously, India can avoid the “production without pipelines” challenge that has slowed early movers. Strategic coordination between central ministries, state governments, and private players can ensure that hydrogen hubs, ports, and industrial users develop in tandem, keeping costs competitive and exports feasible.

Conclusion – Building India’s Backbone Now

India’s green hydrogen ambitions will succeed only if supported by strong, interconnected supply chains. From securing water and renewable energy inputs upstream, to developing pipelines, storage systems, and export-ready ports midstream, and finally, expanding industrial applications downstream, every component of the ecosystem must advance together.

The next few years will determine whether India can move from pilot projects to a truly scalable hydrogen economy. Investments in infrastructure, technology localisation, and coordinated policy design will be the difference between potential and performance.

If India acts decisively and builds its hydrogen backbone now, it can become a major global supplier of green hydrogen and ammonia, driving sustainable growth, jobs, and energy security across Asia. (Source: MNRE, NITI Aayog)