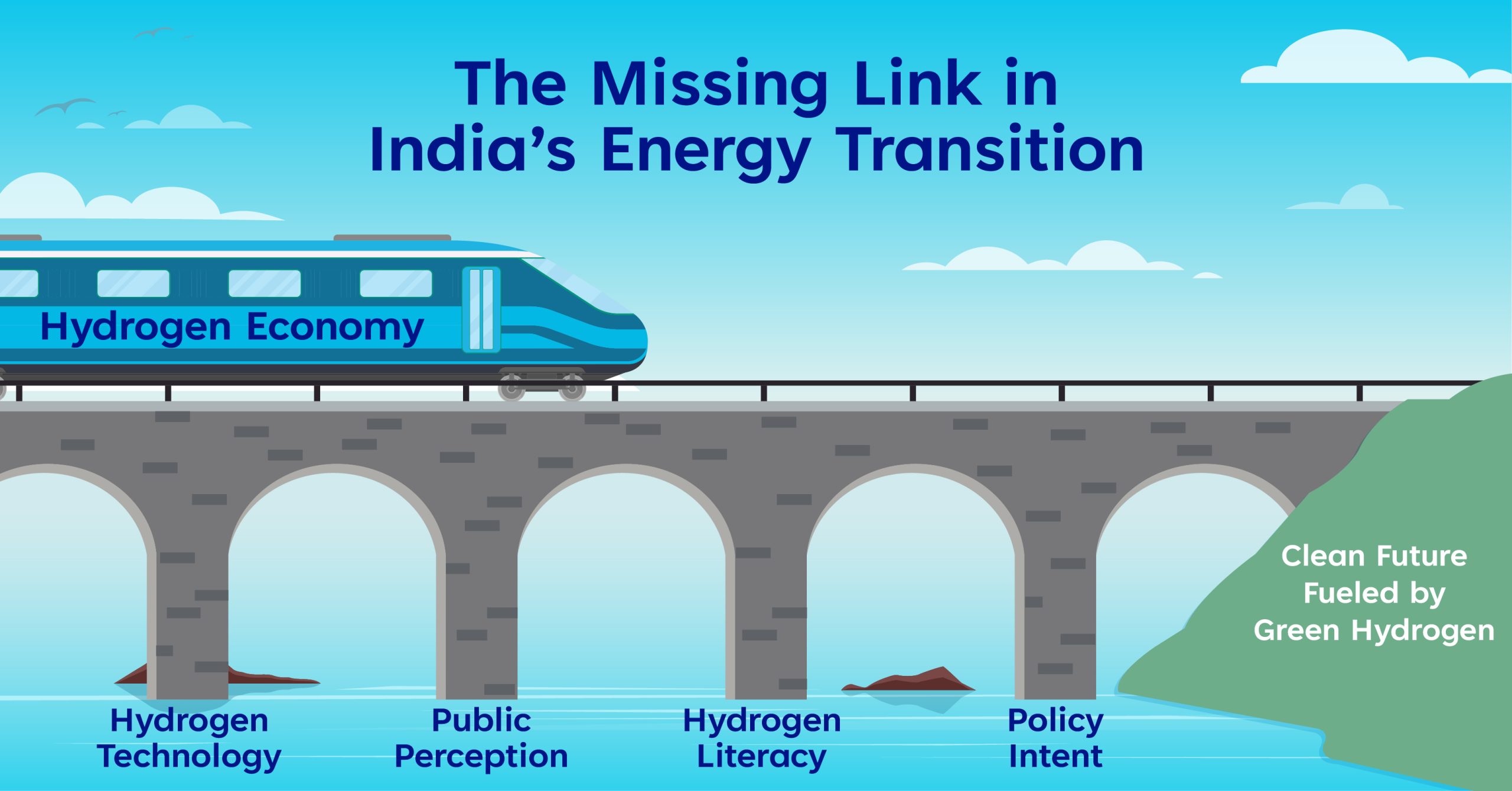

India stands at a pivotal crossroads in its energy transition journey. With its growing population, rising energy demand, and climate commitments, the country must rapidly diversify its energy sources and decarbonise its economy. Hydrogen, particularly green hydrogen, is emerging as a crucial component in this shift. Yet, while the technology is evolving, a significant gap persists between potential and execution, often due to limited hydrogen literacy among those shaping policies, investments, and infrastructure.

(Source: India: Energy sector at crossroads)

Green Hydrogen: A Once-in-a-Generation Opportunity for India’s Energy Leadership

In the deeply entrenched world of energy—an industry shaped over decades by legacy fuels and rigid supply chains—it is rare for a truly new technology to emerge and reset the global playing field. Green hydrogen represents one such breakthrough. Still in its infancy, this technology has not yet been mastered or dominated by any single nation. Unlike solar or wind, where technological leadership is already consolidated, green hydrogen offers a level starting line—and with it, a historic opportunity. For India, this is a once-in-a-lifetime moment to lead in a new energy vertical from the ground up. By moving swiftly and strategically, India can shape global standards, drive cost innovation, and anchor its energy transition on a technology where the rules are still being written.

Why Hydrogen Literacy Matters for Policy and Planning

India aims to produce 5 MMT of green hydrogen annually by 2030 and export the surplus to countries like Japan, South Korea, and the EU region. Achieving this demands alignment across ministries, state governments, planners, and regulators. Without a clear grasp of hydrogen’s unique properties, safety requirements, and supply chain, decision-makers risk creating systems that are incompatible, unsafe, or inefficient.

Yet even when technical understanding improves, implementation often stalls due to broader challenges around regulatory clarity, cost viability, and project bankability—areas where hydrogen’s complexity can overwhelm traditional planning mechanisms.

(Source: National Green Hydrogen Mission (NGHM), Ministry of New and Renewable Energy, India)

Policymakers need a scientific foundation to distinguish hydrogen from conventional fuels. Hydrogen is the lightest molecule, diffuses rapidly, and burns with an invisible flame—features that require specific safety protocols. Poor understanding can result in missteps in zoning, siting, and permitting, especially in urban areas where leak detection and ventilation are critical. The lack of technical know-how at the state and municipal levels often hampers safety inspections and environmental clearances.

Limited knowledge may also favour the tendency to err on the safer side, which can be detrimental for a swift deployment of the technology.

“Too little technical understanding often leads to too many rules”.

Regulators may end up introducing layer upon layer of measures in an attempt to cover all potential risks. While well-intentioned, this approach can result in over-regulation that raises costs, slows deployment, and sometimes even undermines the very objectives it seeks to protect. The effectiveness of regulation in this space does not come from the sheer number of rules, but from their alignment with how the underlying technologies and value chains actually work. A stronger grasp of electrolysis efficiency, grid integration challenges, storage dynamics, and transport safety, for example, enables policymakers to identify which risks truly need mitigation and which do not. This technical grounding allows for proportionate, targeted policies that ensure safety and reliability while still promoting innovation and scale-up. In practice, smarter regulation—built on a deeper understanding of the technology—creates a clearer path for green hydrogen to become a viable pillar of the energy transition.

(Source: Hydrogen as an Alternative Fuel, Harnessing Green Hydrogen, NITI Aayog and RMI)

Hydrogen literacy must encompass a holistic consideration of all techno-economic factors like cost viability, market competitiveness, resistance from traditional competing technologies and safety, which means areas that directly shape policy incentives and investor confidence.

Understanding Regulations and Cost Dynamics

India currently consumes approximately 6 million metric tonnes (MMT) of hydrogen per year, almost all of which is “grey hydrogen” produced using natural gas through a chemical industrial process, steam methane reforming. This hydrogen is primarily used in petroleum refining and ammonia production. Transitioning this existing demand toward green hydrogen (that produced by means of water electrolysis utilizing renewable electricity) is essential not just for emissions reduction, but also for building early domestic market anchors that justify infrastructure and policy investments.

However, India’s current mandate for green hydrogen blending stands at only 5% of total hydrogen consumption, a target that is far below the threshold needed for meaningful decarbonization. This 5% blending target is considered too conservative, especially when benchmarked against global climate goals. Experts suggest a phased roadmap—raising the mandate to 10–15% by 2035—would create stronger demand signals while giving industries time to adapt. Without such calibrated escalation, adoption risks stagnation.

(Source: Status of adoption of green hydrogen in the country – PIB)

Without a clear roadmap to gradually raise this mandate—through industry-specific benchmarks and enforceable timelines—there is a risk that green hydrogen adoption may plateau. A phased mandate expansion, beginning with sectors like refining and fertilisers, that are already intensive hydrogen users, could help create strong demand anchors while allowing industries to adapt and innovate.

While several policies under the National Green Hydrogen Mission are actively moving forward, there are also instances where policies have been announced but not followed through effectively. Some state-level hydrogen roadmaps, announced in 2022–23, have yet to materialise in terms of fund allocations or clear implementation strategies. This gap between announcement and execution remains a serious obstacle to investor confidence.

India’s National Green Hydrogen Mission (NGHM) is demonstrating early progress in making green hydrogen more affordable and investment-worthy. According to a 2025 report by the Institute for Energy Economics and Financial Analysis (IEEFA), the cost of green hydrogen in India is projected to drop by up to 40%, reaching ₹260–310 per kg (USD 3–3.75/kg) by the end of this decade. These cost reductions are being driven by policy measures such as waived interstate transmission charges for renewable electricity, a 5% GST cap on green hydrogen, and preferential funding mechanisms. A recent auction under the Strategic Interventions for Green Hydrogen Transition (SIGHT) scheme discovered prices as low as ₹397/kg, which is significantly lower than international benchmarks, demonstrating India’s cost leadership potential in the global hydrogen economy.

(Source: National Green Hydrogen Mission (NGHM))

Yet despite falling costs, many financial institutions remain hesitant to fund large-scale hydrogen projects unless they can secure predictable returns. The absence of risk-mitigation frameworks, such as government-backed guarantee funds, insurance mechanisms, or a minimum offtake guarantees, increases investor caution—especially in early-stage projects. Unlike solar or wind, hydrogen infrastructure involves more complex value chains and longer return timelines, which makes the lack of financial de-risking tools a major bottleneck.

(Source: Green Hydrogen Organization)

Above all, India must recognise that hydrogen is a long-term strategic fuel—more akin to building a new energy economy than a single-market product. Prioritising quick wins or short-term ROI could derail national climate goals. Instead, hydrogen should be framed as a strategic public good, worthy of the same patient capital and policy continuity that solar and railways once received.

Many financial institutions also express concern over the longer payback periods typical of hydrogen projects. Traditional project finance models, which prioritise quick ROI, often struggle to accommodate hydrogen’s capital-heavy infrastructure. The lack of government-backed guarantee mechanisms, interest subvention, or risk insurance further compounds this hesitation.

While financial viability is crucial for scale, hydrogen’s widespread adoption also hinges on meeting the highest safety and institutional readiness standards, especially as real-world pilots begin to roll out across India.

(Source: Hydrogen vs traditional project finance, OECD, IEEFA – India’s $2.1bn leap towards its green hydrogen vision)

Safety Standards and Institutional Readiness

India has adopted rigorous hydrogen safety norms, many of which exceed global standards. For example, AIS-195 mandates that hydrogen vehicles include sensors to isolate storage systems within 5 seconds if the hydrogen concentration exceeds 4% in enclosed spaces. Pressure relief valves must vent upward to avoid ignition risks. These regulations are enforced strictly; for example, PESO approved India’s first hydrogen refuelling station at Reliance’s Jamnagar facility only after ensuring complete compliance. GreenH Electrolysis (& H2B2 Electrolysis Technologies) applies even more rigorous safety standards. Our electrolysers are equipped with shut-off valves that automatically switch to a safe position if hydrogen concentration crosses 1.4% by volume (35% LEL), while alarms are activated at an earlier threshold of 1.0% by volume (25% LEL). This sets a benchmark of exceptional safety in hydrogen operations.

(Source: Regulations & Standards, National Green Hydrogen Mission Portal, AIS-195, Automotive Research Association of India (ARAI))

India is now testing hydrogen mobility under real-world conditions without major safety incidents. In 2024, MNRE sanctioned five pilot projects involving 37 hydrogen vehicles (15 fuel-cell buses and 22 ICE trucks) and nine refueling stations across Gujarat, Maharashtra, and Delhi-NCR. These vehicles have logged thousands of kilometers, with telemetry monitoring and leak detection systems in place. Alongside these pilots, large-scale projects like IOCL’s 10,000 TPA green hydrogen plant in Panipat and Adani’s 3 GW solar-hydrogen hub signal a shift from demonstration to early adoption.

(Source: India accelerates Hydrogen mobility with new pilot projects)

Turning MOUs into Scalable Projects

Numerous MOUs signed between Indian firms and foreign partners have yet to materialise into tangible projects. Delays in land allocation, environmental clearances, and cross-border coordination have caused several announced partnerships to stall. Strengthening follow-up mechanisms and bilateral progress dashboards could help convert these intent documents into scalable infrastructure.

To ensure accountability, each MOU should include interim milestones, dispute resolution frameworks, and joint working groups with representation from both parties. These structures can prevent stagnation and help scale pilot collaborations into production assets.

(Source: Hydrogen Overview, Ministry of New and Renewable Energy, Press Information Bureau – MNRE Pilot Projects, Economic Times – IOCL, Adani Hydrogen Plans)

But even the most robust national regulations must be translated into region-specific strategies to address India’s diversity in geography, industry, and infrastructure.

To avoid similar delays, India must move beyond high-level agreements and foster bottom-up planning that aligns national ambitions with regional realities.

The Need for Localised Planning and Capacity Building

India’s vast geography and diverse economic landscape mean that a one-size-fits-all approach to hydrogen infrastructure simply won’t work. Effective hydrogen deployment must account for regional variations in renewable energy potential, industrial demand, water availability, and infrastructure readiness. This makes localised planning, not just central directives, critical to the success of India’s hydrogen economy.

(Source: India’s Natural Hydrogen Potential)

For instance, western states like Gujarat and Rajasthan are endowed with abundant solar and wind resources, making them ideal zones for green hydrogen production. However, these regions also face water scarcity, a key consideration since producing one kilogram of hydrogen through electrolysis typically requires 8–10 liters of demineralised water. It is important to note here that water is an equally important consideration in the production of grey hydrogen. Water is a critical life sustaining resource which is to be utilised judiciously, and its consumption cycle must be evaluated over the whole life cycle of hydrogen production, conversion and end use. This presents a complex trade-off between resource availability and sustainability.

(Source: IEER – Hydrogen Report Jan 2024)

On the other hand, industrialised states like Maharashtra, Tamil Nadu, and Karnataka represent significant hydrogen demand centers due to their dense clusters of refineries, automobile manufacturing, steel production, and logistics networks. These states may not have the same renewable generation capacity as western states, but they are well-positioned for end-use deployment, especially in mobility and heavy industry.

(Source: Green hydrogen’s water challenge in India)

Tamil Nadu, with over 20 GW of renewable capacity, strong grid infrastructure, and major ports, is well-positioned for hydrogen exports and industrial uptake. In 2024, the state announced plans to integrate hydrogen corridors and incentivise hydrogen-ready technologies. Yet, aligning supply, logistics, and policy will still require coordinated local planning.

(Source: Tamil Nadu’s Energy Transition Journey, WRI India)

India’s Hydrogen Valley Innovation Clusters (HVICs) mark a strategic shift toward regional, integrated green hydrogen ecosystems. Under the National Green Hydrogen Mission, the government has approved funding of ₹50 crore each for four pilot clusters in Pune, Jodhpur, Bhubaneswar, and Kerala, designed to demonstrate end-to-end hydrogen value chains—from production (via biomass, bioethanol reforming, and electrolysis) to storage, distribution, and industrial offtake such as mobility, steel, fine chemicals, and ammonia production. Going forward, hydrogen valleys should evolve into policy laboratories: places where India can test regulatory models, financing mechanisms, and water-energy nexus strategies, while aligning with national goals for energy security and export competitiveness. Embedding this valley approach into long-term planning would allow India to scale hydrogen in a balanced, regionally adapted, and globally competitive manner.

Globally, hydrogen valleys are already being used as policy laboratories. The European Union has over 65 hydrogen valley projects under the Clean Hydrogen Partnership, linking industrial hubs with renewable resources to accelerate scale. Countries like Japan and South Korea focus their valleys on mobility and port ecosystems, while the United States is channelling billions into hydrogen hubs under the Bipartisan Infrastructure Law to create domestic supply chains. Compared to these, India’s approach is still at an early stage but is distinctive in its emphasis on regional diversity, cost reduction, and integration with energy security goals.

As policy, hydrogen valleys should not remain isolated pilots but evolve into a coordinated national framework. India can use them to test regulatory models, water–energy trade-offs, and financing mechanisms, and then scale successful approaches nationwide. By learning from global best practices while tailoring to its own regional realities, India can turn hydrogen valleys into platforms that secure both domestic decarbonization and export leadership in the emerging global hydrogen economy.

Integrating Hydrogen into State-Level Planning Frameworks

These regional differences highlight the need for state-specific hydrogen strategies that connect central objectives with on-the-ground realities. Urban and regional planners must map out:

- Hydrogen-ready industrial and logistics zones

- Storage and refuelling infrastructure placement

- Renewable energy and water resource mapping

- Workforce training hubs tailored to hydrogen operations

- Risk mitigation plans for safety and community engagement

In fact, a 2024 report by the NITI Aayog emphasises that without decentralised planning, national hydrogen targets may falter due to fragmented state-level implementation. The report calls for integrating hydrogen into state energy roadmaps, urban master plans, and regional industrial policy frameworks.

Moreover, to build planning capacity, the government has committed up to ₹4,440 crore under the National Green Hydrogen Mission to support not just pilot projects but also institutional and workforce development efforts. This funding will be critical for training local officials, updating technical guidelines, and fostering collaboration between state planning boards and central ministries.

But regional planning alone is not enough. A unified national strategy is essential to prevent fragmented efforts across ministries and states from undermining long-term goals.

(Source: Socio-technical barriers to domestic hydrogen futures, Harnessing Green Hydrogen, NITI Aayog and RMI)

A Call for Cross-Ministerial Collaboration

Hydrogen policy intersects with multiple domains, which would be – power, transportation, heavy industries, environment, and science and technology.

Without strong coordination across these entities, policy overlaps, contradictory mandates, and fragmented funding channels can emerge. For instance, the lack of clearly defined Renewable Purchase Obligations (RPOs) and Hydrogen Purchase Obligations (HPOs) at the state level has left distribution companies (discoms) uncertain about their compliance targets for green hydrogen. This slows procurement contracts, deters investors, and delays infrastructure development.

Similarly, confusion has arisen around eligibility criteria for subsidies under different schemes, whether hydrogen generated from hybrid solar-wind systems qualifies equally under MNRE’s Green Hydrogen Mission and the Ministry of Power’s green energy rules. Inconsistent interpretations between ministries create regulatory risk for developers.

To address this, policy experts and think tanks such as FICCI and NITI Aayog have recommended the formation of a National Hydrogen Coordination Task Force that would bring together senior officials from all relevant ministries. Such a body could streamline approvals, align subsidy structures, monitor project execution, and periodically revise safety and technology standards in consultation with industry and scientific experts.

(Source: The Geopolitics of Hydrogen, Harnessing Green Hydrogen, NITI Aayog and RMI, FICCI – Policy Support for Green Hydrogen))

Beyond coordination, stronger execution mechanisms are needed. These include binding commitments from public agencies to track project timelines, along with legal mandates for periodic reporting, site-readiness checklists, and progress audits. Without these, many hydrogen investments may remain trapped in bureaucratic loops.

In parallel, a set of legally binding compliance mechanisms, such as mandatory reporting of hydrogen usage targets, clear timelines for blending mandates, and penalties for delays—could help translate intent into execution. On the incentive side, the government could offer priority access to subsidies, carbon credits, or concessional loans for companies that meet or exceed green hydrogen targets within set timeframes.

The Ministry of New and Renewable Energy has already taken steps in this direction by issuing an implementation framework that assigns nodal responsibilities to different agencies. However, more granular, real-time coordination is needed, especially as hydrogen pilots scale up to commercial deployments across India’s states.

(Source: Ministry of new and renewable energy)

An effective model can be drawn from the European Union’s Hydrogen Strategy, where multiple directorates coordinate hydrogen goals under a unified action plan, tracked by a central monitoring unit. India could replicate a similar dashboard-driven approach at the federal level to ensure consistency and transparency in hydrogen-related policymaking.

Beyond the EU, other countries also offer useful models. Japan, for instance, has integrated green hydrogen into its Basic Energy Strategy and invested in international supply chains, including partnerships with Australia for ammonia-based hydrogen transport. Canada has committed over CAD 1.5 billion through its Clean Fuels Fund to support domestic production and export of low-carbon hydrogen, including tax credits for electrolyser deployment and public–private R&D initiatives. India can benefit by importing hydrogen technology, establishing joint demonstration projects, and training its workforce through knowledge exchanges with these global leaders.

(Source: The green hydrogen role in the global energy transformations )

Domestically, however, R&D in general has often suffered from inconsistent funding cycles, this trend is exacerbated in green hydrogen because of several reasons, including the general public perception, level of adaption and its overall nascent nature. Several university-led research projects and public-private testbeds have faced delays due to lapses in funding continuity or abrupt policy shifts. Long-term R&D commitments are needed to build an innovation pipeline for electrolysers, hydrogen storage materials, and safety tech customised for Indian conditions.

Policymakers must commit to a 5–10 year hydrogen R&D roadmap, co-developed with industry and academia. This includes multi-sector test beds, funding for early-stage startups, and a centralised research registry to avoid duplication. Cross-ministry partnerships (e.g., MNRE, DST, MoEF) can jointly fund thematic areas such as water-use efficiency and off-grid applications.

Even the most advanced technologies and research breakthroughs cannot succeed without public trust—making community engagement and risk perception critical components of India’s hydrogen rollout.

Public Communication and Risk Perception

Planners and policymakers do more than design schemes, they shape how the public perceives emerging technologies. In the case of hydrogen, public acceptance is often influenced more by emotion and trust than by technical facts alone. Without clear, confident communication from officials, even well-designed projects can encounter community resistance, especially in urban areas where perceived risks are amplified.

Public outreach challenges have been reported in other early-stage hydrogen deployments, where planners were technically prepared but administratively unprepared to engage with local communities. Studies show that transparent, proactive risk communication can significantly improve public trust. For instance, the Council on Energy, Environment and Water (CEEW) emphasised that involving local leaders and frontline administrators in communication efforts led to a marked increase in community approval of new energy infrastructure in pilot sites.

This highlights the need for capacity building in science communication, especially at the municipal and state levels. Officials must be equipped not just with technical knowledge but also with the tools to convey confidence and clarity. When government representatives can speak credibly about hydrogen’s properties, safety mechanisms, and benefits, they act as effective bridges between science and society, helping to normalise hydrogen and overcome resistance.

For local authorities, the task is to build operational readiness—understanding emergency protocols, inspection routines, and public interaction frameworks. For the public, messaging must centre around transparency, inclusion, and community benefits. Meanwhile, central policymakers must ensure that safety assurances and education campaigns are built into every pilot and infrastructure rollout. Tailoring communication strategies to each group helps prevent fear-driven pushback and builds societal trust in the hydrogen transition.

(Source: TERI – Decarbonising Transport with Green Hydrogen, CEEW – Building Community Trust for Clean Energy Projects)

Leverage International Models to Accelerate Progress

India’s green hydrogen ambitions can gain significant momentum by learning from countries that are already deploying hydrogen at scale. Nations like Germany, Japan, Canada, and the EU bloc have not only invested heavily in green hydrogen production but also created comprehensive roadmaps covering infrastructure, regulation, and public–private collaboration.

For instance, Germany’s National Hydrogen Strategy includes over €9 billion in funding and prioritises the creation of domestic demand, electrolyser manufacturing, and import partnerships — including those with countries like India. Japan has pioneered fuel cell technology in transportation and household energy, while Canada has built strong interprovincial hydrogen corridors supported by both public and private entities. These examples demonstrate the value of long-term vision, cross-sectoral coordination, and early investments in enabling infrastructure.

(Source: Germany’s Hydrogen Strategy, Springer)

India can adopt and adapt these models by:

- Importing proven technologies such as electrolysers, hydrogen storage systems, and safety monitoring tools

- Developing public–private partnerships to de-risk early investments, as done in Canada’s Clean Hydrogen Alliance

- Creating bilateral task forces to align technical standards, training programs, and trade frameworks

- Participating in global hydrogen platforms for knowledge exchange and harmonisation of policies

Rather than reinventing the wheel, India can selectively localise successful practices to fast-track domestic capacity and avoid early missteps. International collaboration can also boost investor confidence by signalling policy consistency and operational readiness.